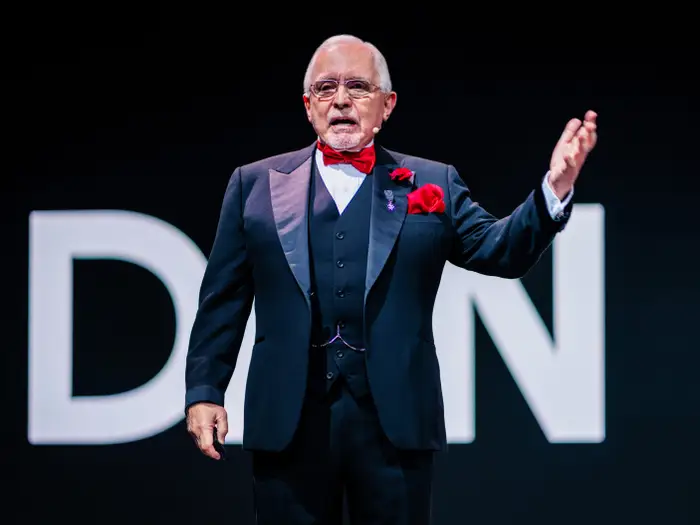

Dan Peña, known as the “Trillion Dollar Man,” has made a name for himself in the business and finance world. With his inimitable personality and real-world advice success could be reached by everyone, the number of people captivated globally has been incredible. But who is this man whose title is so over-the-top? How did he turn his idea into a multi-trillion dollar empire?

Rising from humble origins to tutelaging the new generations of wealth creators, Dan Peña is nothing but phenomenal. His tactics are daring and his practices unorthodox, but they deliver results that few could ever imagine.

So Stay tuned for expanded coverage on how Dan Peña earned his money, what his investment portfolio looks like covering real estate, oil & gas and others, we’ll share a few secrets about his investment strategy and ultimately discover what makes him different than most in his industry. This is not just another rags to riches story; it is a blueprint for anyone wanting to take their dream and make it real. Are you ready to find out how Dan Peña rose to the top in business? Let’s get started!

How Dan Peña made his money

Dan Peña’s road to riches started in the seventies, born out of his uncompromising ambition, and his acute awareness of an opportunity when presented to him. He began his career in finance and quickly ascertained the value of mergers and acquisitions.

Once he hasn established himself, he co-founded The Guthrie Group, an investment management firm which specializes in the water industry. This investment company reveled in big-risk, big reward deals, such as taking ailing companies private. His brash maneuvers wound up paying off.

Peña didn’t just stick with finance — he turned to real estate and bought properties that were undervalued. He was able to see value in markets before they became the darling of the market.

His bold investments extended to oil and gas as well. By aligning himself with the industry, he took advantage of the economic downturn.

At every turn, Dan focused on teaching and sharing through seminars called “QLA” (Quantum Leap Advantage). These teachings have empowered and inspired thousands of people to become financially free.

Dan Peña net worth at a glance

| Net worth | $500 million |

| Born | August 10, 1945 |

| Became a millionaire at | 39 |

| Occupations | Entrepreneur, financial analyst, businessman |

| Sources of wealth | Guthrie Castle, Op-U-Cop, Great Western Resources, QLA, and The Guthrie Group |

| Asset classes | Real estate, energy, startups |

Dan Peña net worth & investment portfolio

Dan Peña’s net worth is always an interesting topic. The estimates say that itapproximately $500 million, but it could be far more than that. He has made this wealth fromvarious investments and business activities.

His portfolio is an eclectic mix and demonstrates abold appetite for risk. Real estate is a big component , with properties worldwide earning massive passive income.

In business, and more specifically, in real estate, oil, and gas, Peña has achieved success andhas somewhat of a track record. Business like these are prime hunting grounds in which to seek growth and profits.

Venture capitalism figures prominently in his strategy as well. By making early investment in exciting Startup companies, he combines the best of innovation with having influence in companies in high- potential businesses in technology, as well as in other arenas. This diversified track record is far more significant than hisblistering financial numbers and shows how attuned he is to market trends.

1. Real estate

Dan Peña’s real estate track record is a testament to his talent to spot a deal. He recognized that this field could bring in a lot of money.

Starting off with modest investments, he rapidly expanded his holdings. His game plan was to buy up undervalued properties, then convert them into cash cows.

Peña was no passive investor and did not simply just buy, dominate and collect; he was deeply involved in the renovation works. This direct approach enabled him to increase property values rapidly.

His interests were not only in the living. Yes, he dabbled in commercial real estate, too — with hopes of even greater earnings potential in multifamily and office buildings.

Peña increased his buying power by using financing options intelligently. This was the kind of risk-taking that distinguished him from many of his contemporaries investors.

Real estate became the basis on which Dan established the majority of his wealth, illustrating the importance of knowledgeable decision making when it comes to selecting investments.

2. Oil & gas

Dan Peña has left a massive impact on the oil and gas industry. He saw energy was always going to be a big sector. Utilizing his network and knowledge of the market, he made strategic investments in number of companies.

And his take was more than just throwing money at trends — it was about reading the global zeitgeist. Peña would often discuss geopolitical events that affected oil prices and short term fluctuations in the market.

One important deal-making was with multiple drilling companies. These were major payoffs as demand soared in booming economy.

Peña also underlined the value of sustainability in the industry. He championed radical technologies to improve efficiency and reduce environmental damage.

This prescient approach enabled him to seize new opportunities, and build his reputation as a sound oil and gas speculator. His adaptability has been essential to sustained success in this tumultuous industry.

3. Venture capitalism

Dan Peña’s venture-capital strategy is an important part of his financial collage. He’s made a number of investments in startups, and all have been thoughtfully selected. His good eye enabled him to pick up things which others miss.

Peña advocates risk taking. Instead, he looks for businesses that have a strong well-established base and are worthy long term investments. His investments include everything from tech companies to groundbreaking consumer products.

He now also actively engages with entrepreneurs, drawing on his wisdom and experience to help guide others. Peña’s portfolio is not only enhanced by this mentoring level of Pena.

Using a mix of gut feeling and market research, Dan Peña builds small business into powerhouse. His venture capital successes have made him known as the “Trillion Dollar Man.”

Dan Peña portfolio returns 2022

2022 Portfolio Review Dan Peña’s portfolio demonstrated tremendous strength during a volatile 2022 market. His investments in a wide array of industries proved to be quite profitable.

Real estate continued to be a major source of his returns. Homes in prime areas appreciated wildly, which is where Peña’s intuition for deals holds.

Under his leadership the oil and gas industry also prospered. Increasing demand and geopolitical strains had these assets gleaming brightly in his investment horizon.

Peña’s venture capital deals also paid off handsomely. In backing such entrepreneurs, he anticipated the promise of nascent technologies that were seizing hold of the future.

His multi-faceted strategy worked well going risk/reward wise in 2022 and is a prime example of why he is taunted by many as the “Trillion Dollar Man” His multi-faceted approach to investing risk vs reward well throughout 2022 may be a good example of why so many call him the “Trillion Dollar Man”. The figures show how well he can adjust and excel in a shifting economic environment.

Dan Peña investment strategy

Dan Peña investment is a mixture of high pressure methods and high confidence. He thinks there are a lot of high-upside plays to make that other people aren’t aware of.

Peña stresses the need to leverage debt. This enables capital to be allocated more heavily without significantly employing personal funds. By stretching his financial resources, he’s enabled to capitalize on market opportunities without delay.

He also recommends a more active stance when investing. Dan doesn’t just throw money at companies, he rolls up his sleeves. From his experience he knows that being passive has been disastrous.

The guy’s entire game plan revolves around networking and such, so that’s fine. Making connections with powerful people enables access to proprietary deals and partnerships that are usually unavailable to the casual investor.

Risk management is ingrained in Peña philosophy. Knowledge of how far he can fall allows him to make educated decisions as he aims for large returns on investments.

Final thought

The story of Dan Peña is one of what can be achieved by setting one’s mind to a goal. His tale is one that motivates entrepreneurs everywhere, proving that success is often born out of taking big chances.

He is not just focused on making money, his teachings are about value creation and resilience. The principles that he followed in life motivate others to surpass what they once thought the limit.

Facing challenges instead of running from them can result in miraculous revolution. Peña lives by this philosophy and shares inspiring and hilarious anecdotes through his investment and personal experience.

His impact is not only financial; it inspires people to be great, in all areas of life. It’s about developing an aggressive culture that moves forward.

So as you think about the legacy of Dan Peña, what are the dreams that make you wake up in the morning? Winning is not about the numbers, it is about having the nerve and the stamina to be part of the race.

Conclusion

Dan Peña’s journey is a story of perseverance, tactics, massive risk and ruthless ambition. From rags to riches, he became one of the most recognizable names in money making, and he has certainly made his mark on the world of investments.

His fortune is not only calculated in numbers, it counts his novel approaches and impetuous nature. Peña’s tactics are taught and have inspired millions of aspiring entrepreneurs.

Knowing how Dan Peña became a business mogul can teach you a lot if you were interested in making money or pursuing entrepreneurship. His story is a testament that anything is possible with enough willpower and the right tactics.

If you’re looking for some inspiration or advice on your own ventures, you might want to take a look at the life, and strategies, of this “Trillion Dollar Man” for some clues on how to survive and, potentially, thrive in the wild world of finance and investing.

Frequently Asked Questions

How did Dan Peña become known as the “Trillion Dollar Man”?

Dan Peña earned the nickname because his track record in wealth creation and making billions of dollars for business was worth shouting about. The unique methodology and risk-taking involved have led many to consider him as a financial guru.

What is Dan Peña’s net worth?

Dan Peña net worth Though the estimates are said to be rough nowadays is around few hundred millions from what can be seen and read from his quotes and statements. According to some reports, he intends to bring about a trillion dollars impact through his investment and business ventures.

What are some key elements of Dan Peña’s investment strategy?

Peña highlights the use of other people’s money, educated risk-taking, and constant attention on the numbers. He is also a proponent of long term instead of short term thinking.

Which industries has he invested in?

Peña has substantial investments in various industries such as real estate, oil & gas, and venture capital. He is a believer in multiple streams of income, which his varied portfolio attests to.

How successful was Dan Peña’s portfolio in 2022?

In 2022, it was difficult for a lot of investors, but Pena was able to maintain good returns due to correct decisions and tactical asset allocation within his holdings.

What advice does Dan Peña give aspiring investors?

He urges people to act instead of waiting for the stars to align. “Learning you can do something and then succeeding builds confidence,” he said–Faith goes before success.

Whether you want build your own business, or you are just curious about ways to make money, taking a look at people like Dan Peña can give you some insights on how to get rich.